Is This the Market Decline We’ve Been Expecting?

Recent market moves have stirred fresh questions.

In the last five days, the S&P 500 slipped about 3.65%, and the Dow Jones Industrial Average fell roughly 4%, marking the fourth straight day of losses. Bitcoin has retreated as well—down around 26% from its recent peak—while gold, which we added to portfolios earlier this year as a strategic diversifier, has dipped to about $4,033 an ounce.

So the natural question is: Has the market turned, and are we entering a meaningful decline?

How This Pullback Compares to Past Corrections

Zooming out provides a helpful perspective. Markets routinely experience several 5–10% pullbacks each year—even during strong bull markets. What we’re seeing right now is still well within the bounds of normal volatility.

Supporting this, S&P 500 companies just delivered 13.1% year-over-year earnings growth, with revenues up 8.3% in the most recent quarter.

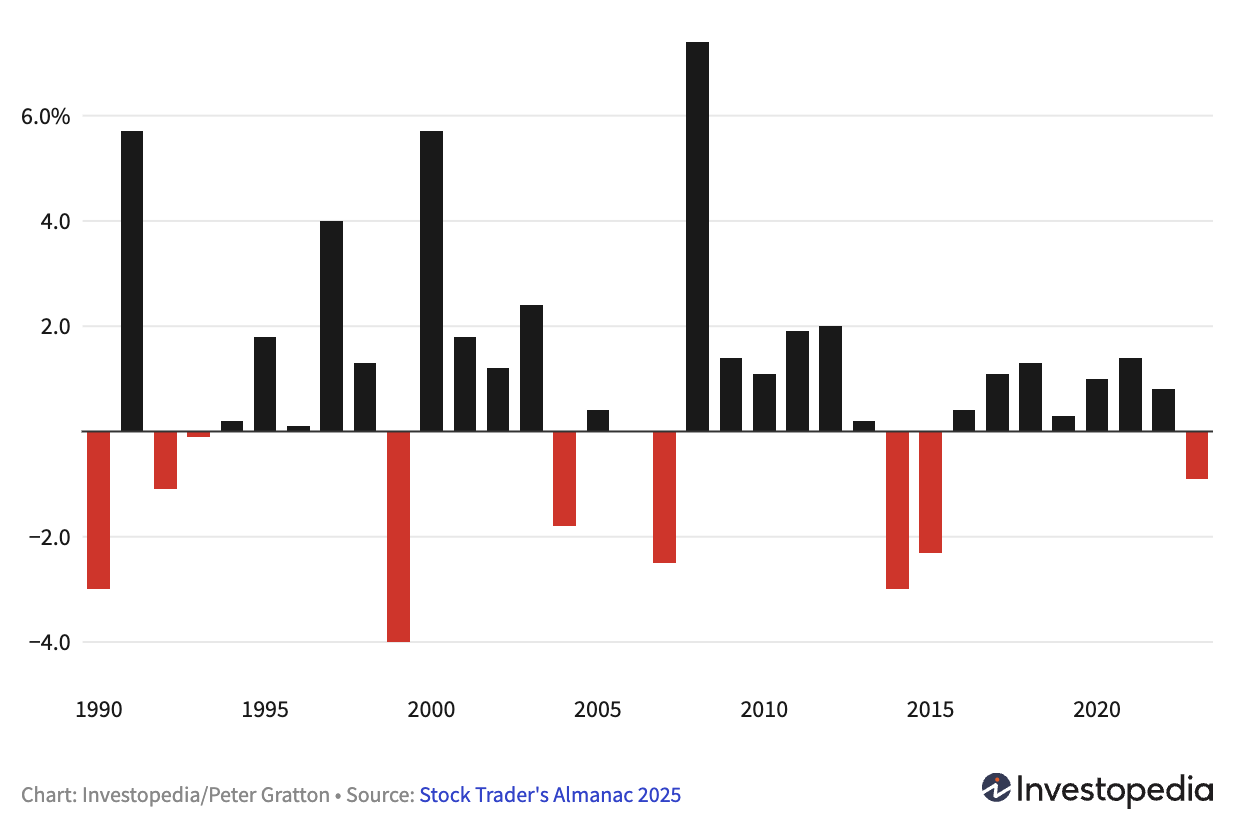

Seasonality also plays a role. November pullbacks aren’t unusual, and historically the market has often regained momentum heading into the “Santa Claus Rally”—the final five trading days of December plus the first two of January. On average, the S&P 500 has gained 1.3% during this period and has been positive about 79% of the time. Meanwhile, the Dow is up 77% of the time, and has gained an average of 1.44% (since 1896)!

But while history is informative, it’s not predictive—and this year’s setup comes with its own mix of uncertainties.

S&P 500 - Santa Claus Rally

What’s Driving the Recent Pullback?

A few forces are contributing to the recent softening in market sentiment:

Rate expectations remain uncertain.

Revisions to the timing of possible Fed rate cuts have pushed risk assets lower.Markets were stretched after a strong 2025 run.

Elevated valuations increase sensitivity to shifts in tone and data.Global and geopolitical noise persists.

Trade developments and geopolitical tensions have added to the market's choppiness.

Technical factors amplified the decline.

Once major indices slipped below support, momentum trading intensified the move.

What This Means for Investors

For disciplined, long-term investors, periods like this are a reminder that volatility is part of the journey. Pullbacks are common—and sometimes healthy—but they also deserve attention. We don’t yet know whether this is a brief pause or the start of a deeper downturn.

What we do know is that the right preparation matters.

How We’re Positioned

Portfolios at Refresh Investments are built with these environments in mind:

Broad diversification across equities, fixed income, real estate, commodities, and alternatives.

Buffered and defensive strategies designed to help cushion deeper market swings.

Strategic allocations, including gold added earlier this year, to support balance when risk assets wobble.

If conditions deteriorate, our process allows for measured adjustments—not reactive moves. We continuously monitor earnings trends, credit conditions, recession indicators, and valuations so we can respond thoughtfully if the landscape shifts further.

Staying the Course—with Flexibility

Whether this pullback stabilizes or evolves into something more prolonged, staying invested, staying diversified, and staying anchored to a long-term strategy remains the best way to navigate uncertainty.

The information provided in this article is for informational purposes only and should not be considered investment advice. There is a risk of loss from investments in securities, including the risk of loss of principal. The information contained herein reflects Refresh Investment’s views as of the date of this presentation. Such views are subject to change at any time without notice due to changes in market or economic conditions and may not necessarily come to pass. Refresh Investments does not provide tax or legal advice. To the extent that any material herein concerns tax or legal matters, such information is not intended to be solely relied upon nor used for the purpose of making tax and/or legal decisions without first seeking independent advice from a tax and/or legal professional. Refresh Investments has obtained the information provided herein from various third party sources believed to be reliable but such information is not guaranteed. Certain links in this site connect to other Web Sites maintained by third parties over whom Refresh Investments has no control. Refresh Investments makes no representations as to the accuracy or any other aspect of information contained in other Web Sites. Any forward looking statements or forecasts are based on assumptions and actual results are expected to vary from any such statements or forecasts. No reliance should be placed on any such statements or forecasts when making any investment decision. Refresh Investments is not responsible for the consequences of any decisions or actions taken as a result of information provided in this presentation and does not warrant or guarantee the accuracy or completeness of this information. No part of this material may be (i) copied, photocopied, or duplicated in any form, by any means, or (ii) redistributed without the prior written consent of Refresh Investments LLC.